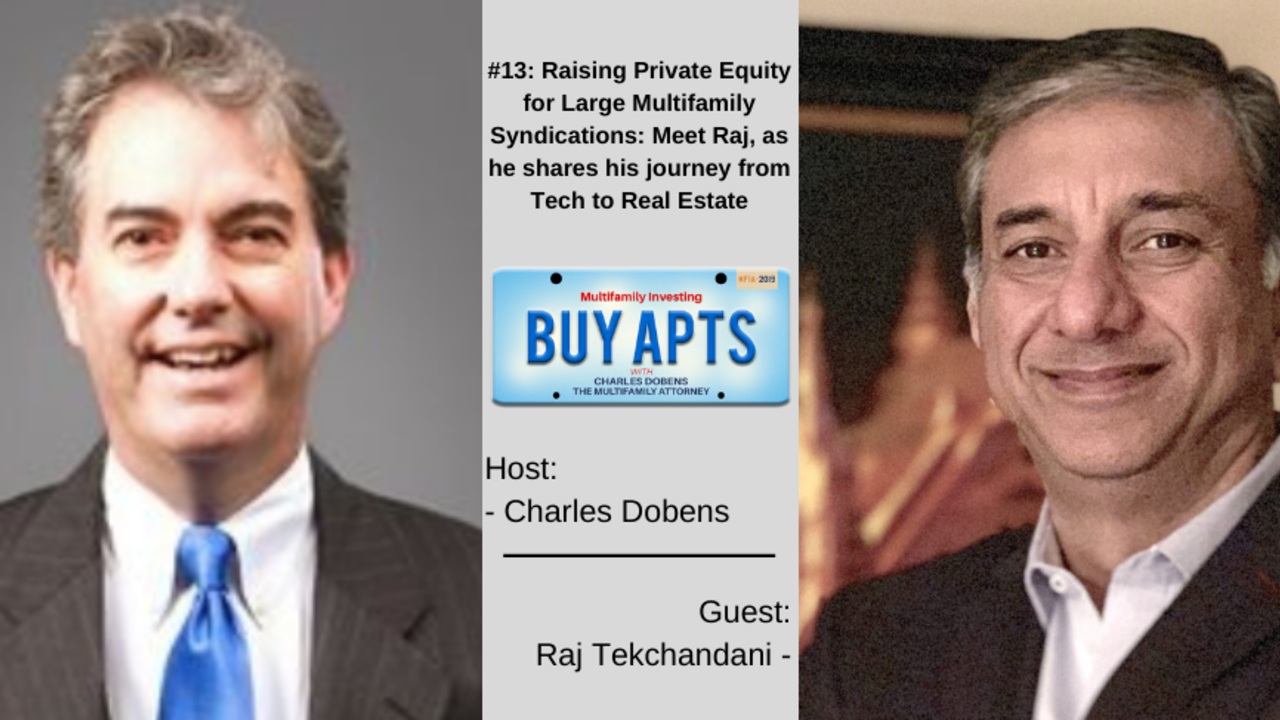

#13: Raising Private Equity for Large Multifamily Syndications: Meet Raj, as he shares his journey from Tech to Real Estate

Jul 24, 2019

Raj Tekchandani, one of my favorite clients, joins me today on my podcast. Find out how you should build a business that always has the capital ready for when you find that great deal! Raj is not only doing it, but he is also doing it the right way.

Listen to all our episodes and leave a review: HERE

Download Podcast: HERE

Subscribe: Apple | Google Play | Stitcher | Spotify

Raising Private Equity for Large Multifamily Syndications: Meet Raj, as he shares his journey from Tech to Real Estate.

Raj was once a seasoned technology entrepreneur who is now a full-time real estate investor. Raj had spent over three decades working with tech startups.

In 2012, Raj had his start in real estate investing when he purchased a single-family condo. In 2018 left his W-2 to pursue his interest in real estate and stumbled upon syndication. Raj has created a meetup group in Boston that is unique in that it is a boardroom style and everyone is there to learn from each other.

In this episode we also cover:

- How to factor in all expenses

- His role as a co sponsor and managing investors relations.

- The properties that he syndicates

- What he looks for in the IRR

- The power of the cap rate

- How Raj uses his background from analytics in real estate

Connect with Raj:

Links mentioned in the show:

We Need Your Help!

Help us reach a broader audience on iTunes by leaving the podcast a rating and review. It takes just 30 seconds! You can leave a review by going: HERE